(Best AI Tools)The financial market is a complex and dynamic environment where accuracy, speed, and efficiency are paramount. In recent years, Artificial Intelligence (AI) has become an indispensable tool in deciphering market trends, analyzing vast amounts of data, and making informed decisions. This blog post introduces some of the best AI tools currently revolutionizing financial market analysis, helping investors, traders, and financial analysts stay ahead in the game.

1. Bloomberg Terminal: Comprehensive Market Analytics

The Bloomberg Terminal is a computer software system provided by Bloomberg L.P. that enables professionals in the finance sector to access the Bloomberg Professional service through which users can monitor and analyze real-time financial market data. It integrates AI for advanced market analytics, portfolio management, and sophisticated financial modeling. Its AI algorithms are adept at processing vast market data to provide actionable insights.

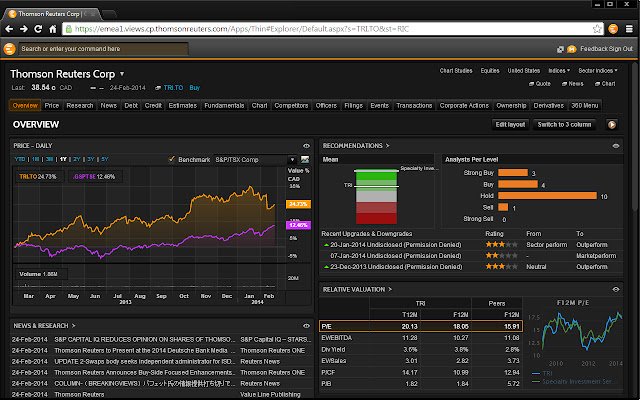

2. Thomson Reuters Eikon: AI-Driven Financial Analysis

Thomson Reuters Eikon offers powerful and intuitive tools for financial market analysis. Its AI capabilities include advanced data analytics, graphical tools, and natural language processing for news analysis. Eikon’s AI-driven insights are crucial for understanding market trends and making data-driven investment decisions.

3. AlgoTrader: Automated Trading Solutions

AlgoTrader is an automated trading software that allows traders to implement any trading strategy using a flexible, open-source platform. It leverages AI to optimize trading strategies, back-test performance, and execute trades automatically. For quantitative traders, AlgoTrader’s AI algorithms can process market data in real time to identify trading opportunities.

4. Sentieo: AI for Financial Research

Sentieo combines traditional and alternative data sets to provide comprehensive financial research. Its AI-driven tools include document search, data visualization, and financial modeling. Sentieo’s AI algorithms can analyze earnings call transcripts, SEC filings, news, and other sources to extract relevant insights for financial analysis.

5. Kensho: AI for Event Recognition

Kensho is known for its capabilities in event recognition and analysis. Its AI algorithms are designed to understand the impact of various events, such as economic reports, geopolitical events, and natural disasters, on financial markets. Kensho provides analysts with a sophisticated tool for assessing the potential market impact of a wide range of events.

6. BlackRock’s Aladdin: Risk Management and Operational Tools

BlackRock’s Aladdin utilizes AI to provide comprehensive risk management and operational tools for investment professionals. Aladdin’s strength lies in its ability to analyze large datasets to assess investment risks and opportunities, making it a valuable tool for portfolio management and strategic asset allocation.

7. Trading Technologies: High-Performance Trading Software

Trading Technologies creates high-performance trading software for professionals. Its AI-powered tools are designed for high-frequency trading, offering rapid trade execution and real-time market data analysis. The AI algorithms can detect subtle market patterns and execute trades at optimal times.

8. Crunchbase: AI for Market Intelligence

Crunchbase offers AI-driven market intelligence, particularly useful for investors and analysts focusing on startups and private companies. Its AI tools analyze trends in fundraising, mergers and acquisitions, and industry developments, providing users with valuable insights into emerging market sectors.

9. TipRanks: Smart Score Stocks

TipRanks employs AI to provide investors with a ‘Smart Score’ for stocks. This score is based on eight market factors, including analyst ratings, hedge fund activity, and news sentiment. TipRanks’ AI aggregates and analyzes data from these various sources to provide a comprehensive view of a stock’s potential.

Conclusion

In the fast-paced world of financial markets, AI tools have become essential for success. These tools provide comprehensive market analysis, risk assessment, and investment insights, helping professionals make informed, data-driven decisions. By leveraging AI, financial analysts, traders, and investors can navigate market complexities with greater precision and insight, staying ahead of market trends and optimizing their investment strategies. As AI technology continues to evolve, its role in financial market analysis will undoubtedly expand, offering even more sophisticated tools for market participants.